A Hermes delivery van hit the corner of our house when reversing out our drive in November.

He damaged the garage roof, facia boarding and guttering, leaving a hole which we later discovered would cost £1,400 to repair.

The driver apologised repeatedly and told us he would report the incident at the depot. He also advised us to contact Hermes, which I did, but I could only reach the firm via an online chat, which was very frustrating.

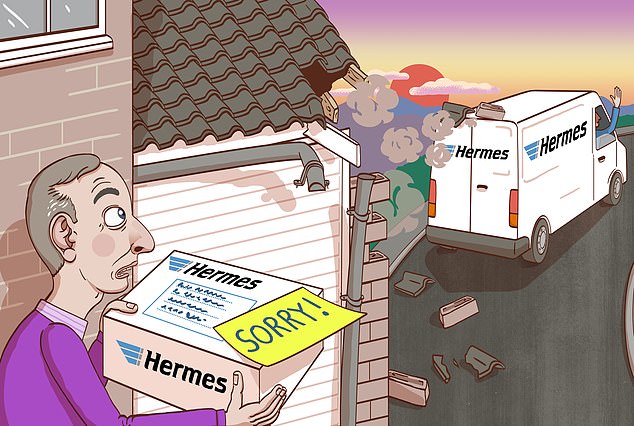

Hit and run: A Hermes driver reversed into a reader’s home causing some £1,400 worth of damage

Since then I have received emails stating only that my parcel has been delivered and the incident is being investigated.

I sent details of my complaint to the chief executive of Hermes, Martijn De Lange. Two days later I received a response on his behalf to say I would be updated in 48 hours. It has now been more than a month since the incident and we have heard nothing.

B. H., Carmarthenshire.

Tony Hazell replies: What a stressful experience. You are in your 70s and have been left in fear of a huge bill through no fault of your own.

Accidents happen, but Hermes should have leapt into action upon learning of the damage caused by its driver. Instead, it failed time and again to respond to your complaints or keep you updated.

Like you, I’m sick and tired of companies forcing customers to use online chat services. Had you been able to speak to a human on the phone, this saga could have been avoided.

Fortunately, Hermes was far quicker to respond to my inquiries. Within 24 hours you received an apology and reassurance the full bill would be paid. It also offered an extra £100 as a gesture of goodwill.

A spokesman says: ‘We have been in contact with the customer to apologise for the delay in resolving this and reassure him that Hermes will of course cover all the repair costs.’

NatWest locked injured boy’s trust account

I am a trustee for an account set up when a boy suffered a tragic accident resulting in a catastrophic brain injury. Of the three original trustees, I am one of two survivors.

In 2020 I asked NatWest for details of the balance as I wished to move the money.

I was told the account had been closed and transferred to a dormant database.

I completed a reclaim form, enclosing a certified true copy of the trust document, and I requested copies of all bank statements and letters that had purportedly been sent to my home address.

Despite living at the same property for over 30 years, I had not received any statements.

NatWest then asked for proof that one of the trustees had died, which I supplied. On February 24, NatWest said it could not verify the trust beneficiary’s address.

For almost a year now I have been battling to gain access to this money.

Name and address supplied.

Tony Hazell replies: Why is NatWest incapable of verifying an address when given the correct postcode?

You sent certified details of the beneficiary’s Santander account, yet the bank kept asking for manual certified details of their identity, which you repeatedly supplied. This really should not have been difficult, but NatWest plumbed the depths of ineptitude.

It says the account was not accessed for five years and so was classed as dormant. A spokesman says: ‘We recognise the service experienced by the trustee has not been satisfactory.

‘Having spoken to them to complete outstanding information, we can confirm that the family of the beneficiary has now received the funds.’

NatWest has paid the beneficiary £750 compensation and sent you £200 to cover any costs involved in visiting the branch and calling.

The bank has also arranged for gifts to be sent to you and the family of the beneficiary in acknowledgement of the distress caused.

This reader has has trouble when cancelling her phone contract with Tesco mobile

Tesco Mobile waived cancellation fee but still sent in the debt collectors

We have been with Tesco Mobile for four years. In November 2021, we moved to a retirement village near Bristol, where there is no mobile phone signal.

After discussion with a senior staff member, Tesco agreed to let us cancel our contract and waive the £144 still due.

But the next month, a debt collector said we needed to pay this money. I contacted Tesco and it confirmed that we were not liable. But now we’ve received a further letter from the debt collector.

R. M., Bristol.

Tony Hazell replies: Tesco apologises. The debt collector has been called off and your credit rating will not be affected.

- Write to asktony@dailymail. co.uk or Ask Tony, Money Mail, Northcliffe House, 2 Derry Street, London W8 5TT. Please include your phone number, address and a note addressed to the offending organisation giving permission to talk to Tony Hazell. We regret we cannot reply to individual letters. Please do not send original documents as we cannot take responsibility for them. No legal responsibility can be accepted by the Daily Mail for answers given

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.