U.S. stocks very likely will retest their early-March low and maybe even fail that test.

This sobering prospect emerges from a contrarian analysis of stock market sentiment. Currently the “wall of worry” that markets climb is too flimsy to support much of a rally.

This isn’t the narrative on Wall Street, which is telling investors the market is experiencing “peak bearishness.” That would be a good sign, according to contrarian analysis.

I don’t buy it. A more accurate description of what we’re seeing is a “peak” in detecting peak bearishness. That has far different contrarian implications, since an eagerness to believe that the worst is behind us is a hallmark of the “slope of hope” that market corrections descend.

It’s a good bet that at the final bottom of the market’s current correction, far fewer on Wall Street will be insisting that we’ve seen peak bearishness.

Not that you can’t find pockets of extreme pessimism. But the overall picture is far less pessimistic. On those occasions when one indicator is suggesting extreme pessimism, others aren’t.

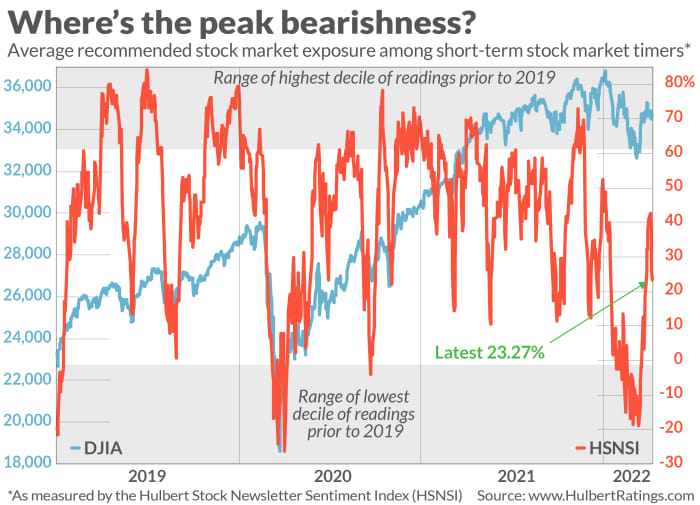

A good illustration of this episodic and inconsistent pessimism is provided by the two stock-market sentiment indices that my firm maintains: The Hulbert Stock Newsletter Sentiment Index (HSNSI) and the Hulbert Nasdaq Newsletter Sentiment Index (HNNSI). Each reflects the average recommended equity exposure level among a particular subset of short-term stock market timers, and while in general they are significantly correlated, there are occasions in which the two diverge.

Last month was one such occasion. There has been no trading session since March 15 in which both the HSNSI and the HNNI were in the bottom 10% of their respective historical distributions. It’s been three weeks since either one was in its bottom decile. This is hardly a picture of peak bearishness.

To ret a read on what other sentiment measures are saying, I reached out to Hayes Martin, president of the advisory firm Market Extremes. Martin’s predictions of market turning points have been impressive. (For the record: Martin does not have an investment newsletter; my newsletter-tracking firm does not audit his investment performance.)

In an email, Martin said that his review of numerous sentiment indicators tells him that “the deep-rooted pessimism seen at significant bottoms is clearly lacking.” The pockets of bearishness that do appear now and then are “selective and transient.” We are “considerably short of the peak bearishness narrative.”

What peak bearishness looks like

To paint a picture of what peak bearishness does look like, consider the bear market bottom in March 2020. As I pointed out in a column three weeks ago, on the day of that low both of my firm’s sentiment indices had been in the bottom deciles of their historical distributions for eight of the prior nine trading sessions. A the March 2009 bottom, these two sentiment indices had been in their bottom deciles for 17 straight market sessions.

The chart above shows the HSNSI as it now stands. Short-term market timers who focus on the broad stock market are recommending that their clients allocate 23.3% of their trading portfolios to buying stocks. That’s at the 28th percentile of its historical distribution — well-above the bottom decile that in previous columns I have defined as the zone of extreme bearishness. My firm’s other stock market sentiment indicator, the HNNSI, is painting a similar picture; though not shown in the accompanying graph, it is at the 29th percentile of its distribution.

Assuming the stock market follows the contrarian script, the bottom won’t come until sentiment indicators paint a picture of extreme bearishness — and stay there for several days at a minimum.

So be careful not to jump the gun. Your eagerness to do so is yet more evidence that the bottom is not yet at hand.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com

Also read: 20 high-volatility stocks you might want to avoid in a hair-trigger market

Plus: Dow transports are in a ditch. Can the stock market and the economy be far behind?