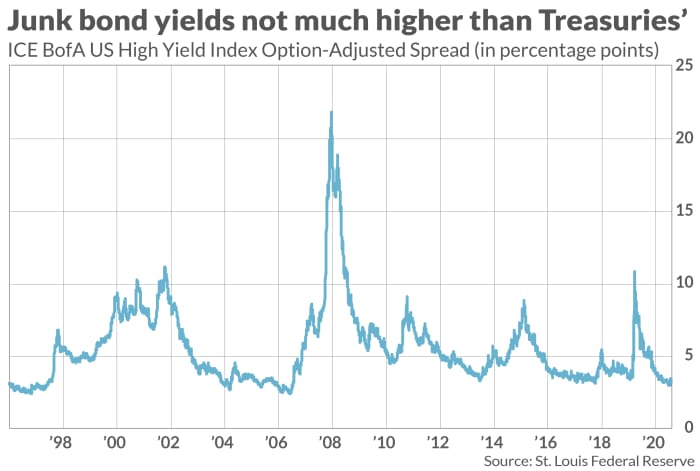

Here’s another indication that investors now are dangerously exuberant: The junk bond spread has rarely been lower than where it stands today.

That’s worrisome because past occasions of a low junk bond spread have often preceded periods of economic trouble, if not actual downturns. As a result, low junk bond yields typically don’t stay low for long.

The junk bond spread is the difference in the yields of junk bonds and those of Treasurys of comparable maturities. It represents the compensation that investors are demanding for incurring the additional risk of holding junk bonds instead of Treasurys. When the spread is low, like it is now, investors are behaving as though holding junk bonds involves relatively little additional risk.

The chart below shows where the junk spread stands today relative to its history since the 1990s. It currently is 3.4 percentage points, well-below the 25-year average of 5.5 percentage points. As you can see, there have been only two other sustained periods since the mid-1990s when the junk spread got as low as it is today: Prior to the bursting of the internet bubble and just prior to the Great Financial Crisis.

To be sure, as the chart also shows, the spread briefly got as low as it is today in 2014 and 2018, and neither occasion presaged an economic recession. Nevertheless, in each case the spread almost immediately widened considerably, more than doubling.

It would be particularly ominous if such a doubling were to occur today, given the fragile state of U.S. corporate balance sheets. As I’ve pointed out before, most companies are barely profitable; the bulk of the profits collectively earned by all publicly traded corporations are concentrated in the 100 most profitable firms. In 2020, for example, among companies in the S&P 1500 index, this proportion was 91.8%.

Since most of the companies outside of the top 100 are not consistently profitable from year to year, many of their debt ratings are already in the “junk” category. So if the junk spread were to widen considerably, many of them would have grave difficulty paying their debt-service costs — even if Treasury yields stayed low.

To determine the likely course of the junk spread, I measured the correlations between its level at any given time and how much it rises or falls over the subsequent quarter-, year- and two-year periods. In all cases there was an inverse correlation, meaning that the junk spread is strongly mean-reverting: high spreads are more often than not followed by lower ones, just as low spreads are far more often than not followed by higher ones. These correlations are all significant at the 95% confidence level that statisticians often use when determining if a pattern is genuine.

Particularly noteworthy is that correlations are stronger at the two-year horizon than at the one-year horizon. Correlations for the one-year horizon are in turn stronger than for the one-quarter horizon. That’s significant because most other sentiment indicators have their greatest explanatory power at the one-quarter or shorter horizon. So the junk bond spread is one of those rare contrarian indicators that can help us gauge longer-term prospects.

Assuming the future is like the past, we therefore can predict with some confidence that the junk spread is likely to be much higher than where it is today with a couple of years. It’s not unlikely that an economic recession will occur in the next couple of years, but even if that’s not the case, companies with lower debt-quality ratings will face much higher debt service costs. Those investing in junk bonds could incur substantial losses. Plan accordingly.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com

More: Why stocks still suffer bear markets even when the U.S. economy is growing

Also read: As gold prices fall, there’s still not enough gloom to trigger a buy signal

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/CGYPT6WE7VAO3KJ773SHUVMVBY.jpg?resize=1200,630&ssl=1)